Nobel Laureate and Former Energy Secretary Steven Chu

Former Fed Chairs

Alan Greenspan & Paul Volcker

Former Fed Chair Ben Bernanke

Current Secretary of the Treasury and

Former Fed Chair Janet Yellen

Link to video

Climate Scientist

James Hansen

Climate Scientist

Katharine HayHoe

Former Rep Francis Rooney R-FL

Andrew Yang

Democratic Presidential Candidate

|

Details

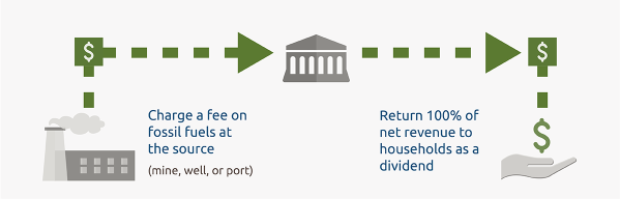

Impose a fee on carbon, and have the

government return the money equally to

everybody in the form of a monthly dividend

immediately, before the

politicians can get their grubby fingers on it.

Revenue neutral

.

- The carbon fee should be imposed at the

wellhead, or when fuel is imported.

- The dividend payments should be frequent,

perhaps monthly, because poor people who really

need the dividend to make ends meet in the face of

higher energy costs often can't wait a year for

the help.

- The fee should also be imposed on gases released

into the atmosphere as a side effect of

production, and it shouldn't just be a simple fee

on carbon, since some chemicals are more potent

greenhouse gases. So a severe fee should be

imposed on methane that is leaked into the

atmosphere without being burned in natural gas

drilling, since methane is much more potent than

CO2 as a green house gas.

- Border adjustments (otherwise known as tariffs)

should be

imposed on goods imported from countries that

aren't imposing similar carbon fees, to protect

American producers from unfair competition from

goods imported from countries that don't have such

fees. This gives other countries an incentive to

impose their own carbon fees, so they get the

money rather than our government getting the

money. This avoids the need for ambitions,

grandiose

international treaties that are nearly impossible

to get together and even harder to enforce. Revenues

from the tariffs would be used to subsidize exports to

countries without a carbon tax.

- In practice, a few high-income people are emitting

far more GHG's per capita than the rest, so

others, which includes most voters, would be getting more

money back in the dividend than they would be

paying in higher energy costs, so they would come

out ahead, which would create a political

constituency to keep raising the fee until it is

high enough to motivate the desired reductions in

emissions. Also, once people see that they are

receiving monthly checks, that also creates a

constituency opposed to the politicians diverting

the revenues to other ends.

- The incentives provided by the carbon fee will

render a lot of legislation redundant and

unnecessary, so that regulations can be

repealed,

moving decision making from bureaucracy and courts

to more efficient and optimal market-based

decisions.

- Generally, it will be much simpler and more efficient

for industrialists and policy makers to make decisions

based on a fossil fuel price that is taxed to reflect

ecological harm, rather than having to hire armies of

lawyers to make heads or tails of the reams of Byzantine

regulation that would otherwise be necessary.

Drawback

- Unlawful residents would be negatively impacted,

since they would face higher energy costs yet not

receive the dividend. However, by the same

argument, social security, medicare, medicaid, and

unemployment insurance should all be abolished,

since unlawful residents pay taxes that support

those programs and don't receive the benefits. It is virtually impossible to

run any kind of decent society without

sometimes negatively impacting unlawful

residents. That's just a basic,

unavoidable fact of reality.

Current Action on Carbon Fee

and Dividend

- The

Energy Innovation and Carbon Dividend Act

(EICDA, H.R. 5744)

is a bill in the federal house of

representatives. Initially sponsored in the

last session by several Republicans and numerous

Democrats, it was re-sponsored in the current

session, and as of April 2, 2022 was co-sponsored

by 96 Representatives, and gaining a few more

representatives every month. It was just re-introduced

in the currnt congress in October, 2023.

-

Citizens' Climate Lobby is an organization

dedicated to bipartisan solutions to climate change.

They focus on many climate bills, particularly

EICDA.

- The

Climate Leadership Council is a Republican

group with a plan very, very similar to the

EICDA, except

that they don't have a bill in

congress, and their version exempts the fossil

fuel industry for legal liability for any fraud

they may have perpetrated by telling the public

that climate change is not real while internal

documents showed that they knew this wasn't the

case. The EICDA does not have

this exemption -- it leaves open the possibility

of legal action against fossil fuel companies.

- The idea of a carbon fee and dividend as the

right approach to solving climate change is

endorsed by:

- all living ex-Fed chairs

- 28 Nobel Laureate economists

- 15 former chairs of the Council of Economic

Advisors

- 2 former treasury secretaries

- and 3623 other US economists.

The endorsements above are for the

general concept of a carbon fee and dividend, and not

specifically the EICDA

or the Climate Leadership

Council's proposal. There are

other endorsements and editorials

supporting the idea.

Elon Musk has

endorsed the idea of a "price on carbon",

but his opinions on

Carbon Fee and Dividend, specifically, are

unknown.

|